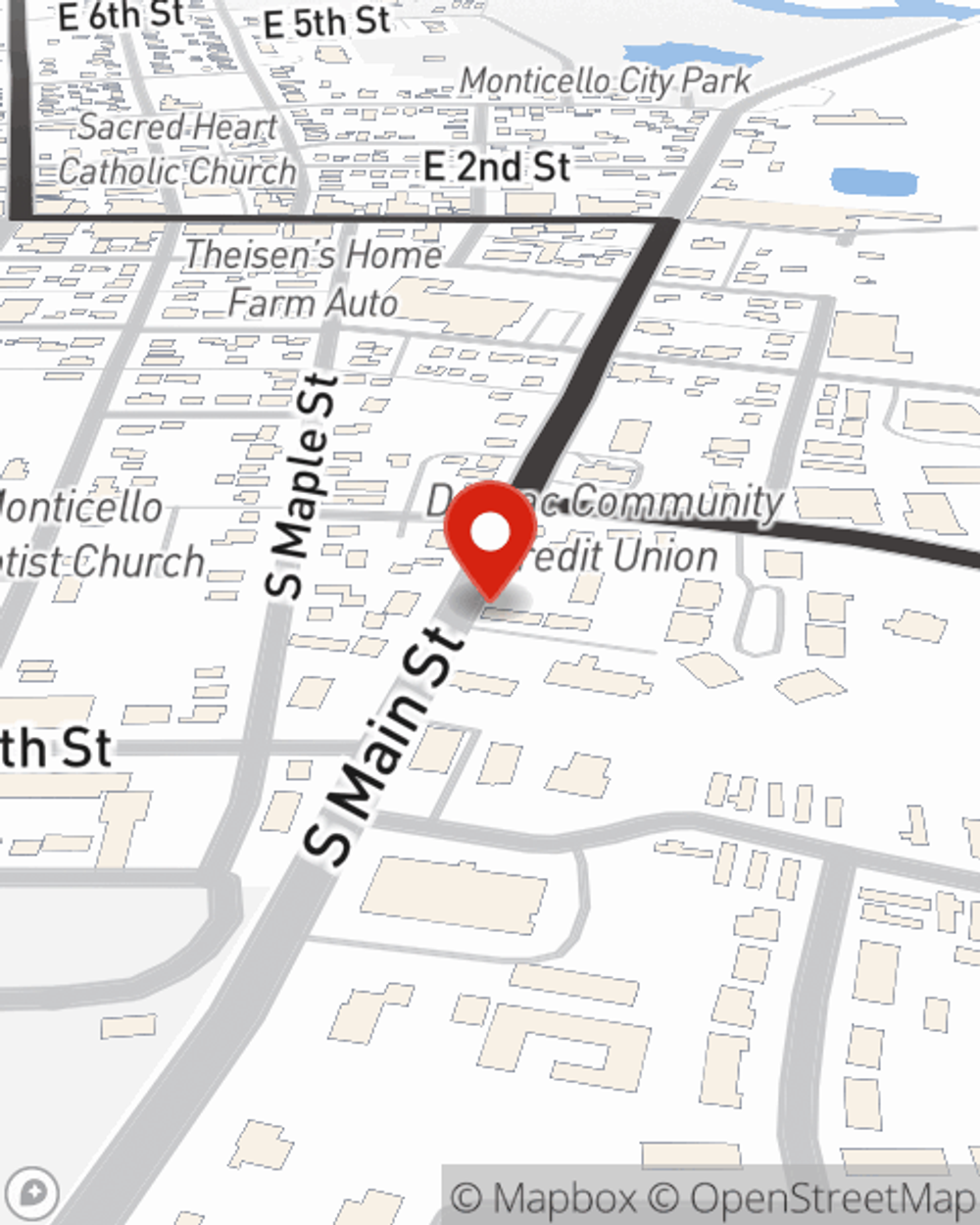

Business Insurance in and around Monticello

One of Monticello’s top choices for small business insurance.

Helping insure small businesses since 1935

- Monticello

- Anamosa

- Cascade

- Jones County

- Delaware County

- Wyoming

- Scotch Grove

- Hale

- Central City

- Center Junction

- Olin

- Onslow

- Springville

- Stone City

- Fairview

- Hopkinton

- Delhi

- Langworthy

- Dubuque County

- Linn County

Business Insurance At A Great Price!

Do you own a home cleaning service, an art gallery or a stained glass shop? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on your next steps.

One of Monticello’s top choices for small business insurance.

Helping insure small businesses since 1935

Keep Your Business Secure

Your business thrives off your tenacity determination, and having outstanding coverage with State Farm. While you make decisions for the future of your business and support your customers, let State Farm do their part in supporting you with commercial liability umbrella policies, commercial auto policies and worker’s compensation.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Rick Meyer is here to help you discuss your options. Reach out today!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Rick Meyer

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.